Shriram Finance, one of India's largest non-banking financial companies, has partnered with Microsoft to develop Shriram One, a cloud-native app that consolidates lending, deposits, insurance and payments into a single interface and has been downloaded by 20 million users.

Parts of the platform run on Microsoft Azure, with Microsoft Defender for Cloud and Microsoft Sentinel providing security and compliance monitoring, the company said.

The app supports seven Indian languages, a feature the company said is central to reaching customers in semi-urban and rural areas, where 63% of new users are based, with a further 27% coming from Tier-2 cities.

Monthly fixed deposit volumes processed through the app have grown more than threefold over two years, rising from Rs 80 crore to nearly Rs 300 crore, equivalent to approximately $9.5 million to $35 million.

The company said customers report faster onboarding and fewer branch visits, citing the example of a long-haul truck driver who applied for a Rs 5 lakh commercial vehicle loan through the app and received approval within a week.

Gayadhar Behera, chief technology officer at Shriram Finance, said the company needed a partner to help its teams develop new skills as the pace of development increased.

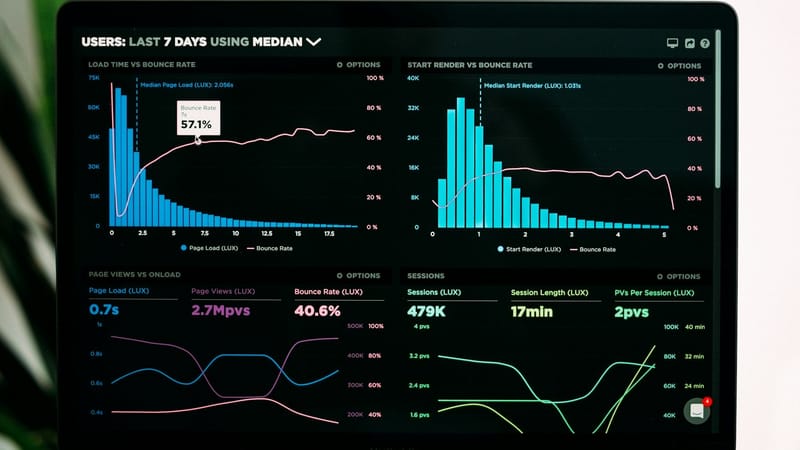

The platform uses analytics and artificial intelligence to personalise product recommendations and detect anomalies in near real time.

Related reading

- Windows 11 gains rebuilt MIDI stack with support for newer MIDI 2.0 standard

- Most US healthcare providers yet to deploy agentic AI despite growing confidence in its potential

- monday.com is pushing AI incentives as partner program helps drive adoption

Panakala Raju, chief software officer at Novac Technologies, which supports the platform, said a chatbot is being trained to handle routine collections, assist with fixed deposit renewals and route complex queries to human agents.

Shriram Finance said all customer data is hosted within India in line with local regulatory requirements.

The Recap

- Shriram Finance built Shriram One with Microsoft technology.

- The app has 20 million downloads as of January 31.

- Monthly fixed deposits grew from Rs 80 crore to Rs 300 crore.