Kraken, the US cryptocurrency exchange, has integrated its over-the-counter (OTC) trading desk into ICE Chat, the institutional messaging platform operated by Intercontinental Exchange (ICE), making it the first cryptocurrency platform approved to connect to the network.

The integration gives ICE Chat's user base of more than 120,000 clients direct access to Kraken's OTC desk from within the same communications environment they use for trading across global financial markets.

OTC desks allow institutional investors to execute large cryptocurrency trades directly with a counterparty rather than through a public exchange order book, typically to minimise market impact.

The connection covers Kraken's liquidity across both crypto spot and options markets, and is aimed at trading desks in major financial centres seeking to access digital assets through familiar infrastructure.

Gurpreet Oberoi, head of Kraken Institutional, said the integration reduced operational friction and onboarding overhead by allowing clients to engage with Kraken's OTC desk without leaving their existing workflows.

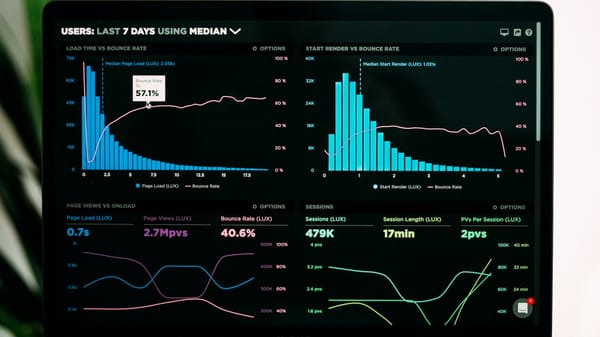

Maurisa Baumann, ICE's head of global data delivery platforms, said ICE Chat offered always-on, compliant connectivity and included AI-powered smart text recognition, a feature that converts messages into structured, actionable trading data.

Related reading

- Kraken deploys AI tools across compliance and risk operations

- Kraken lists Pepcoin as trading goes live on the exchange

- monday.com is pushing AI incentives as partner program helps drive adoption

Kraken said it expects to expand the integration across additional initiatives over time, reflecting what it described as a broader trend of digital assets becoming embedded in established institutional market infrastructure.

The move follows growing efforts by cryptocurrency firms to court institutional clients by meeting compliance and workflow requirements that have historically made crypto markets difficult to access from within traditional financial systems.

The Recap

- Kraken integrated its OTC desk into ICE Chat.

- ICE Chat network includes over 120,000 institutional clients worldwide.

- Company says it will expand integration across additional initiatives.