Figma files for New York IPO

Snapshot

- Figma aims to raise up to $1.5 billion

- Shares to trade on NYSE as “FIG”

- It's another signal that the IPO market is thawing

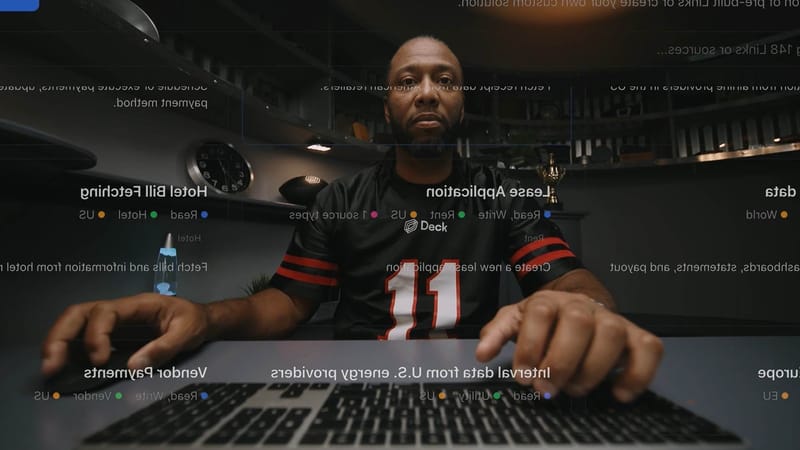

Figma, the collaborative design platform used to create digital 'user experience' (UX), has filed for a proposed stock market float in New York.

With an S-1 registration filing to the US Securities and Exchange Commission (SEC), the firm is launching its IPO process, giving investors the opportunity to buy into a business that generated $749 million in revenue in 2024.

That marked a 48% jump in revenue, supported by heightened customer activity amidst the 'AI revolution'.

Ahead of the IPO, Figma noted that co-founder and CEO Dylan Field will continue to steer the company, as he will retain around 75% of the design software firm's voting rights (via 'super voting' Class B shares).

The Figma IPO comes amid resurging public markets for tech companies, with investors favouring high-growth stocks in a rally that's recovered ground since April's tariff speedbump.

Figma is said to feature in the team-based design workflows of 95% of Fortune 500 companies.