A week in biotech: Four IPOs launch in a single week as Eli Lilly breaks the trillion-dollar barrier

After years of capital drought, investors are flooding back into biotech startups while obesity drug makers cement their dominance and regulators crack down on cheaper alternatives

The biotech sector just had its busiest week in years.

Four companies went public in a matter of days, collectively raising close to $1 billion. Eli Lilly became the first pharmaceutical company to cross a $1 trillion market capitalisation. And the FDA opened a new front in its war against compounded weight-loss drugs, targeting telehealth giant Hims & Hers with potential criminal referrals.

The flurry of activity marks a dramatic shift for an industry that spent the better part of three years stuck in a funding freeze. IPO windows slammed shut in late 2021, M&A stalled, and venture capitalists retreated to safer bets. Now, with public markets reopening and Big Pharma racing to replenish pipelines ahead of looming patent cliffs, biotech is roaring back.

The IPO drought finally breaks

Agomab Therapeutics, Eikon Therapeutics, Spyglass Pharma, and Veradermics all priced offerings this week, raising nearly $1 billion combined. The quartet represents the strongest single-week performance for biotech IPOs since early 2021, when pandemic-era exuberance still fuelled the sector.

Investor appetite appears genuine rather than speculative. All four companies are clinical-stage, with lead programmes in areas ranging from inflammatory bowel disease to oncology. None are pre-clinical moonshots or platform plays without drugs in development. The message from underwriters and institutional buyers is clear: biotech with real data and near-term milestones can access public capital again.

The IPO resurgence follows a record-setting industry conference last month. Biotech Showcase 2026 drew 2,800 attendees, including 1,144 investors, and facilitated 6,000 partnering and investment meetings across four days. Company presentations topped 250. The event's scale reflects renewed confidence that biotech's long winter is ending.

Eli Lilly joins the trillion-dollar club on obesity drug sales

Eli Lilly reported a 45% surge in full-year 2025 revenue on 4 February, driven almost entirely by sales of Mounjaro and Zepbound, its two blockbuster GLP-1 drugs for diabetes and obesity. The earnings beat pushed the Indianapolis-based pharmaceutical giant's market cap above $1 trillion, making it only the second healthcare company ever to reach that milestone after Johnson & Johnson briefly touched it in 2024.

GLP-1 drugs have become the most valuable pharmaceutical franchise in history. Lilly and rival Novo Nordisk now dominate a market expected to exceed $100 billion annually by 2030. Wall Street analysts project that Lilly's next-generation oral GLP-1, orforglipron, could reach $16 billion in annual sales by 2031 if approved. The FDA granted priority review this month, with a decision expected by March.

The obesity drug boom has reshaped pharma's competitive hierarchy. Lilly's market cap now exceeds that of Pfizer, Merck, and AbbVie combined. Novo Nordisk briefly became Europe's most valuable company last year. Smaller biotech firms racing to develop competing therapies are attracting massive investments, fuelling the IPO revival and M&A frenzy.

FDA targets compounded weight-loss drugs in escalating crackdown

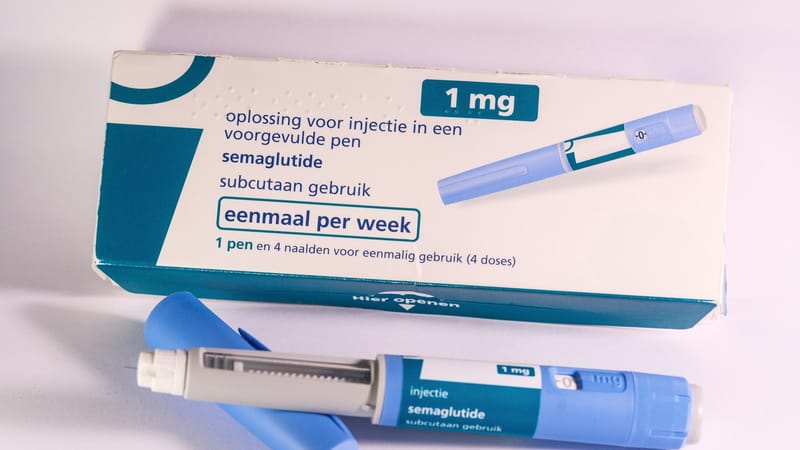

The regulatory backlash arrived Friday. The FDA announced it would restrict access to compounded semaglutide, the active ingredient in Ozempic and Wegovy, and refer telehealth company Hims & Hers to the Department of Justice for potential violations of federal law.

Hims & Hers had been selling a $49-per-month compounded version of semaglutide directly to consumers through its online platform, undercutting Novo Nordisk's roughly $1,000 monthly list price by more than 95%. The company argued it was filling gaps created by widespread shortages of brand-name GLP-1 drugs. Regulators say the practice violates laws designed to ensure drug safety and protect intellectual property.

The crackdown comes as major pharmaceutical companies lobby aggressively to shut down compounding pharmacies. Novo Nordisk and Lilly have both filed lawsuits against compounders and telehealth providers, arguing that outsourcing production of complex peptide drugs to unregulated facilities creates serious safety risks. Consumer advocates counter that the brand-name drugs remain unaffordable for millions of Americans, even as supplies normalise.

The FDA's decision to involve the Justice Department signals the agency intends to treat compounded GLP-1s as a law enforcement matter, not merely a regulatory compliance issue. Hims & Hers' stock fell 12% in after-hours trading following the announcement.

M&A activity hits record pace as Big Pharma confronts patent cliff

Biotech dealmaking is running at the hottest pace in years. Cumulative M&A deal value reached $49 billion by late 2025, already surpassing the $44 billion recorded for all of 2024. Analysts predict 2026 will set a new record, driven by Big Pharma companies racing to acquire clinical-stage assets before key patents expire.

Pfizer, Bristol Myers Squibb, and AbbVie all face major revenue losses over the next three years as blockbuster drugs lose exclusivity. AbbVie's Humira, once the world's top-selling drug, has already faced biosimilar competition. Pfizer's COVID-19 products are declining rapidly. Bristol Myers' cancer drugs Revlimid and Opdivo face patent expirations that will erase tens of billions in annual sales.

Acquiring late-stage biotech companies offers a faster route to replenishing pipelines than internal R&D. Several analysts have speculated that Lilly's orforglipron could become an acquisition target if the FDA grants approval, though the company's soaring valuation makes a buyout less likely now.

The IPO window reopening gives biotech founders and venture investors an alternative to selling early. Companies with strong clinical data can now pursue public listings and retain independence, potentially commanding higher valuations if programmes succeed.

Federal research agency and major drugmakers cut staff

Not everyone is benefiting from biotech's resurgence. ARPA-H, the federal research agency created to fund high-risk medical breakthroughs, laid off an undisclosed number of staffers in early February as part of broader government healthcare reorganisation. The agency's budget and mission remain uncertain under the new administration.

GSK announced it would trim its R&D workforce by up to 350 positions globally, affecting fewer than 50 workers in the U.K. and fewer than 70 in the U.S. The cuts are part of a strategic reorganisation aimed at focusing resources on the company's most promising therapeutic areas.

Genentech, Roche's U.S. subsidiary, laid off 118 employees at its South San Francisco headquarters this week in the third round of cuts this year. The biotech pioneer has now eliminated 348 positions since January, reflecting broader cost-cutting across Roche's operations as the Swiss drugmaker faces slowing sales growth.

The workforce reductions stand in sharp contrast to the sector's overall momentum. Companies raising fresh capital through IPOs and M&A deals are hiring aggressively, while established players prune headcount to improve margins. The divergence suggests biotech's recovery remains uneven, favouring companies with near-term catalysts over those relying on government funding or long-term research bets.

Critical FDA decisions loom this month

The agency faces several high-stakes approval decisions in February. On 8 February, regulators are expected to rule on the first gene therapy for Hunter syndrome, a rare genetic disorder that primarily affects boys. Approval would mark a significant milestone for gene therapy and offer hope to families with limited treatment options.

On 20 February, the FDA will decide whether to approve pembrolizumab for platinum-resistant ovarian cancer, a notoriously difficult-to-treat disease. Pembrolizumab, marketed as Keytruda by Merck, is already one of the world's top-selling drugs, generating more than $25 billion annually across multiple cancer indications. Adding ovarian cancer would expand its label and cement its position as the most successful immuno-oncology therapy ever developed.

Both decisions carry major financial implications. The gene therapy approval could validate a manufacturing approach other companies are pursuing for rare diseases. The pembrolizumab expansion would extend Keytruda's dominance and likely accelerate Merck's efforts to develop next-generation cancer immunotherapies before the drug's patent expires in 2028.

The takeaway

Biotech is moving fast again. The IPO market has reopened, Big Pharma is spending aggressively to acquire pipeline assets, and regulators are drawing new battle lines around obesity drugs and compounding practices. After three years of stagnation, capital is flowing back into the sector, driven by genuine clinical progress and looming patent cliffs that are forcing established companies to look outside their own labs for growth.

Whether this momentum lasts will depend on how well newly public companies execute, whether M&A valuations remain rational, and how aggressively regulators restrict lower-cost alternatives to blockbuster drugs. For now, though, biotech has its swagger back.